It would be easy to look at 2010 and focus on the negative. Difficult economic times, including higher levels of unemployment, have put downward pressure on procedure volumes. The financing environment has been challenging overall, but especially so for earlier-stage companies. FDA regulatory changes, reimbursement and healthcare reform have created significant uncertainty regarding the ability to get new products approved and reimbursed. Among all of the challenges, however, lie an increasing number of positive signs for the new year.

The economy appears to be on the mend

Despite a setback in the November unemployment numbers, unemployment is still down from its peak of 10.1 percent and is expected to continue to decline. The economy appears to be growing again. Though gradual, the quarterly gross domestic product (GDP) has steadily increased since 2Q09. (See Exhibit 1.)

Exhibit 1: Quarterly GDP in the U.S.: 4Q07 to 3Q10

As the economy rebounds, procedure volume is expected to increase. Against this backdrop, the demographic trends for spine and orthopaedics remain firmly in place. According to the U.S. Census Bureau, 12 percent of all Americans were 65 and older in 2004, and it is expected that that population will grow to 21 percent by 2050. In addition, despite the uncertainty created by H.R. 3590, up to 32 million Americans may be added to insured status, potentially enhancing the opportunities created by these demographic trends.

Public equity valuations are relatively flat, but cash positions continue to rise

Over the past two years, despite significant volatility, share prices for spine and orthopaedic companies have remained relatively flat. Orthopaedic bellwethers Johnson & Johnson and Medtronic have returned approximately four percent and eight percent, respectively, since 2009. Companies that have shown improving share price trends, such as ArthroCare and BioMimetic Therapeutics, have taken advantage of those increased valuations to raise capital. In Exhibit 2, we highlight the change in market capitalization for the past 12 months for publicly traded orthopaedic and spine companies. We have arranged the companies by market cap as of 12/6/10 – less than $500 million, greater than $1 billion and between $500 million and $1 billion.

Exhibit 2: Change in Market Capitalization of Global Orthopaedic and Spine Companies: 2009 to Present

Exhibit 3: Change in Cash Balances ($MM) in the Orthopaedic and Spine Sector

M&A activity discussions returning

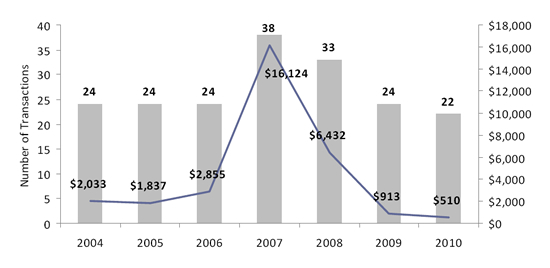

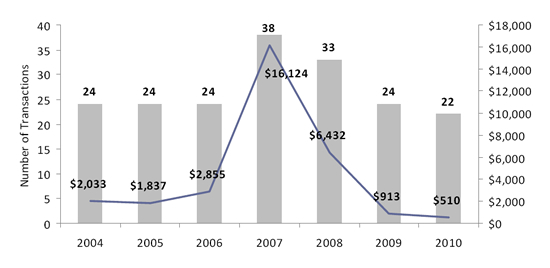

The year 2010 saw a similar number of deals in the spine and orthopaedics space as in 2009 (22 vs. 24 deals in 2009), but the announced value actually declined approximately 40 percent, from $913 million in total deals in 2009 to $510 million in 2010. (See Exhibit 4.)

Exhibit 4: Global Orthopaedics and Spine M&A Activity: 2004 to 2010

During the last six months, we have seen a dramatic increase in incoming calls from spine and orthopaedic companies looking for acquisition targets, as well as an increase in the number of management calls and meetings held to discuss M&A strategy, a noticeable shift from the preceding 12 months, in which it was difficult to get potential acquirers and targets to come to the table. It is fairly reasonable to expect current acquisition trends to continue. Companies are increasingly looking to focus on acquisitions of more innovative companies, rather than focusing on merely reducing costs.

Private equity on the prowl

A landmark transaction within the spine and orthopaedics space was Welsh Carson’s investment in K2M. Welsh Carson is regarded as one of the leading private equity firms on Wall Street. Prior to K2M, they invested in AGA Medical in July 2005 at a $300 million valuation. In October 2009, AGA Medical went public at a market cap of $755 million. On October 15, 2010, St. Jude acquired the company for approximately $1.3 billion. That seems to be a good blueprint for K2M. Welsh Carson’s investment in K2M creates another potential acquirer in the spine market and is a strong validation of the continued opportunities in the space.

Conversations with a number of private equity groups suggest strong interest in following a similar blueprint. Ideal candidates would include those with commercial visibility, unique and innovative technologies, large market opportunities and high barriers to entry.

Bright spots in venture capital

The venture capital (VC) community overall continues to struggle raising money, but there were a number of bright spots. NEA, Bain Capital Ventures, SV Life Sciences and OrbiMed Advisors all raised new funds of over $500 million. However, the biggest medtech news may have taken place outside of orthopaedics. Medtronic’s acquisition of Ardian on November 22 and Boston Scientific’s acquisition of Sadra on November 19 breathed new life into the venture community. Ardian is developing a catheter-based device targeting the $5 billion anti-hypertension market. The company released a study in November 2010 showing that its catheter-based device was effective in reducing hypertension in patients who hadn’t responded to drugs and other treatments without any serious procedure-related events. Medtronic will make an upfront cash payment of $800 million, plus commercial milestones equal to the annual revenue growth through the end of Medtronic’s fiscal year 2015.

Sadra is developing the first fully repositionable device for percutaneous aortic valve replacement to treat patients with severe aortic stenosis. The agreement calls for an upfront payment of $225M plus additional potential payments of up to $225M upon achievement of specified regulatory and revenue-based milestones through 2016.

Though not centered in the orthopaedic and spine space, transactions like these tend to remind venture capitalists and, more importantly, their limited partners about the enormous return potential in medical devices.

Despite those significant transactions, VCs still have limited appetite for new investments. As we help private companies raise money to fund operations, we can no longer just approach a group of 20 to 25 VCs. Now, we have to turn to a much broader group of equity investors and complement that with strategic investors or nontraditional sources of capital. Strategic investors have emerged as particularly important.

In the past several years, companies like Boston Scientific, Johnson & Johnson and Medtronic have actively invested in startup companies. Today, a new breed of companies has emerged to invest in early stage companies, as well. We have noticed a change over the last several months as a new host of strategic companies are stepping up to evaluate potential investments. These strategic partners are looking to augment their own R&D pipeline by finding companies with products targeting large market opportunities, strong clinical data and high barriers to entry. In our discussions with orthopaedic companies, they have mentioned several targeted areas of high interest, notably orthobiologics, minimally invasive procedures, products targeting a younger patient population, extremities and degenerative spine treatments.

IPO Market?

One of the most intriguing questions for 2011 is whether or not Tornier and BioHorizons will successfully test the initial public offering (IPO) market. Tornier, a leader in the extremities market, filed for an IPO on June 8, 2010. BioHorizons, a leading developer, manufacturer and marketer of dental implants, filed for its IPO on June 23, 2010. Both companies have revenues exceeding $75 million. They appear to be the type of companies that can possibly reopen an IPO market.

We have conducted an analysis of all medical device IPOs since 1990. (See Exhibit 5.) In the last 20 years, there have been three windows during which the medical device IPO market has been effectively closed: 1999 to 2000, 2001 through 2003 and the current window.

Exhibit 5: IPO Window Activity in the U.S.: 1990 to 2009

According to Brit Stephens, Managing Director at Morgan Keegan, there exists a “cautious optimism for the IPO market in 2011 as the window opens for solid companies with good products and good growth. The buy-side will still be cautious about valuation, but as the economy continues to show increasing signs of improvement, that concern should ease a bit. Liquidity will remain a focus for investors, but the attraction of out-sized growth opportunities addressing large markets will out-weigh concerns about size.”

If Tornier and BioHorizons are able to go public and, more importantly, meet or exceed investor expectations, we could see the IPO door open wider for a broader group of medical device companies. An active IPO market would create exit opportunities for VCs and private equity groups, as well as increased activity and competition around M&A transactions. These IPOs will be events to watch in 2011.

Conclusion

Even with the changes being seen in the FDA regulatory process, reimbursement and healthcare reform environments, we expect that good technologies addressing large markets will continue to attract private investment and, as these companies mature, they will be sought after by larger, public companies that need to meet their growth objectives.

Stephen Blumenreich, a managing director with Morgan Keegan & Co., has approximately 20 years of experience advising middle market companies. He focuses on the medical device sector and has completed capital raising and M&A transactions in the aesthetics, cardiovascular, diabetes, diagnostics, general surgery, orthopaedics and spine subsectors. Blumenreich began his career in the M&A Group at Salomon Brothers before joining Alex Brown & Sons in the Health Care Group. Most recently, Blumenreich was co-head of the Medical Device Group at Thomas Weisel Partners, where he helped build one of the leading medical device underwriters on Wall Street. He joined Morgan Keegan in 2009.

Christopher Dorn, an investment banker with Morgan Keegan & Co., has been advising middle market healthcare companies for the past five years, completing a number of capital raising and M&A transactions in both the medical device and healthcare IT sectors. He began his career in equity research at Morgan Keegan and worked in the Healthcare Investment Banking Group at SunTrust Robinson Humphrey before joining Morgan Keegan’s investment banking practice in 2008.

This article also appeared in ORTHOKNOW® December 2010. Due to its timely nature, we are republishing it here in its entirety.—Editor